Navigating the complex world of debt can be overwhelming, especially when facing the prospect of bankruptcy. While bankruptcy can offer a fresh start, it’s crucial to explore all options for managing debt before resorting to such a drastic measure.

This comprehensive guide provides practical tips and strategies for effectively managing your debt, improving your financial habits, and making informed decisions about your future.

By understanding your debt situation, exploring debt management options, and improving your financial habits, you can empower yourself to take control of your finances and potentially avoid the need for bankruptcy. This guide will delve into these key areas, providing insights and resources to help you navigate the challenges of debt and make informed choices about your financial well-being.

Understanding Your Debt Situation

Taking control of your debt before filing for bankruptcy requires a clear understanding of your financial situation. This involves analyzing your income, expenses, and the types of debt you owe.

Creating a Detailed Budget

A detailed budget is crucial for understanding your financial situation. It helps you identify areas where you can cut expenses and free up cash to pay down debt. A budget tracks your income and expenses over a specific period, typically a month.

By carefully recording all your income sources and expenditures, you can gain valuable insights into your spending habits and identify areas where you can reduce costs.

Types of Debt and Interest Rates

Different types of debt come with varying interest rates. It’s important to understand these differences to prioritize debt repayment.

- Credit Cards: Credit cards often have high interest rates, which can quickly escalate your debt burden. It’s important to prioritize paying down credit card debt due to the high interest rates.

- Personal Loans: Personal loans can have lower interest rates than credit cards but are still considered high-interest debt.

- Student Loans: Student loans may have fixed or variable interest rates, and repayment terms can vary depending on the loan type.

- Medical Debt: Medical debt can be a significant financial burden, and it’s important to negotiate payment plans or explore options for reducing the amount owed.

Obtaining Free Credit Reports and Scores

Your credit score is a crucial factor in determining interest rates and loan terms. You can obtain free credit reports from the three major credit bureaus:

- Experian

- Equifax

- TransUnion

You are entitled to one free credit report from each bureau annually through AnnualCreditReport.com .

Negotiating with Creditors

Negotiating with creditors can help you lower interest rates, reduce balances, or obtain more favorable repayment terms.

- Be Polite and Professional: When contacting creditors, it’s important to be polite and professional. Explain your situation clearly and respectfully.

- Offer a Written Proposal: Prepare a written proposal outlining your proposed changes, such as a lower interest rate or a reduced balance. This demonstrates your seriousness and commitment to resolving the debt.

- Be Prepared to Negotiate: Be prepared to negotiate and compromise to reach a mutually agreeable solution. Be realistic about what you can afford and be willing to make concessions.

Exploring Debt Management Options

When you’re drowning in debt, it’s easy to feel overwhelmed and hopeless. But before you consider bankruptcy, there are several debt management strategies you can explore that might help you get back on your feet. These options can help you reduce your debt, lower your interest rates, and potentially improve your credit score.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a new interest rate and payment schedule. This can be a good option if you have high-interest debts, such as credit cards or payday loans.

- Pros:

- Lower monthly payments. This can make it easier to manage your debt.

- Lower interest rates. You may qualify for a lower interest rate on a consolidation loan, especially if you have good credit.

- Simplified repayment. You’ll only have one payment to make each month, instead of multiple payments.

- Cons:

- Longer repayment term. You may end up paying more interest over the life of the loan if you choose a longer repayment term.

- Potential for higher overall interest. If you don’t qualify for a lower interest rate, you may end up paying more in interest over the life of the loan.

- Risk of consolidating bad debt. Consolidating high-interest debt into a lower-interest loan can be a good strategy, but be careful not to consolidate debt that you can’t afford to repay.

Credit Counseling

Credit counseling involves working with a certified credit counselor to develop a debt management plan. Credit counselors can help you understand your debt situation, negotiate with creditors, and create a budget to help you get out of debt.

- Pros:

- Free or low-cost services. Many credit counseling agencies offer free or low-cost services.

- Personalized debt management plan. A credit counselor can work with you to create a debt management plan that fits your individual needs and circumstances.

- Negotiation with creditors. Credit counselors can help you negotiate with creditors to lower your interest rates, waive late fees, or reduce your monthly payments.

- Cons:

- Potential for fees. Some credit counseling agencies charge fees for their services.

- Limited impact on credit score. Credit counseling may not have a significant impact on your credit score, as it doesn’t necessarily involve paying off your debt faster.

- Not a quick fix. Credit counseling can take time, and you may need to make significant lifestyle changes to get out of debt.

Debt Settlement

Debt settlement involves negotiating with your creditors to settle your debt for less than what you owe. This can be a good option if you’re struggling to make your payments and are considering bankruptcy.

- Pros:

- Lower debt balance. You may be able to settle your debt for a fraction of what you owe.

- Reduced monthly payments. You’ll have lower monthly payments, making it easier to manage your debt.

- Avoid bankruptcy. Debt settlement can help you avoid bankruptcy, which can have a negative impact on your credit score and future borrowing ability.

- Cons:

- Significant fees. Debt settlement companies typically charge high fees for their services.

- Negative impact on credit score. Debt settlement can have a negative impact on your credit score, as it often involves late payments or defaulting on your debt.

- Potential for legal issues. Some debt settlement companies operate illegally, and you may end up with legal issues if you work with a disreputable company.

Role of a Credit Counselor

A credit counselor plays a crucial role in helping individuals develop a debt management plan. They provide financial guidance and support to individuals struggling with debt. Credit counselors can help you:

- Understand your debt situation. They can help you identify your debts, calculate your monthly expenses, and create a budget.

- Develop a debt management plan. They can help you create a personalized debt management plan that fits your individual needs and circumstances.

- Negotiate with creditors. They can help you negotiate with creditors to lower your interest rates, waive late fees, or reduce your monthly payments.

- Improve your financial literacy. They can teach you about budgeting, credit management, and other financial topics.

Comparison of Debt Management Companies

Here is a table comparing the features and benefits of different debt management companies:

| Company | Services Offered | Fees | Credit Score Impact | Pros | Cons |

|---|---|---|---|---|---|

| National Foundation for Credit Counseling (NFCC) | Credit counseling, debt management plans, financial education | Fees vary by agency | May have a positive impact on credit score if you follow the plan | Nonprofit organization, experienced counselors, affordable services | May not be able to negotiate with all creditors |

| Consumer Credit Counseling Service (CCCS) | Credit counseling, debt management plans, financial education | Fees vary by agency | May have a positive impact on credit score if you follow the plan | Nonprofit organization, experienced counselors, affordable services | May not be able to negotiate with all creditors |

| Debt.com | Debt consolidation, credit counseling, debt settlement | Fees vary by service | May have a negative impact on credit score if you choose debt settlement | Wide range of services, online platform | High fees, potential for legal issues with debt settlement |

| Freedom Debt Relief | Debt settlement | High fees | Negative impact on credit score | May be able to settle debt for less than what you owe | High fees, potential for legal issues |

Improving Your Financial Habits

Even if you’re facing a difficult financial situation, it’s crucial to focus on improving your financial habits for the long term. By taking control of your spending and income, you can build a stronger financial foundation and prevent future debt accumulation.

Building a Savings Plan and Emergency Fund

Creating a savings plan and establishing an emergency fund are vital for financial stability. A savings plan helps you consistently set aside money for future goals, while an emergency fund provides a safety net for unexpected expenses.

- Set Realistic Savings Goals:Determine your financial goals, such as buying a house, paying for education, or retiring early, and set realistic savings targets based on your income and expenses.

- Automate Savings:Schedule regular automatic transfers from your checking account to your savings account. This helps you save consistently without actively thinking about it.

- Build an Emergency Fund:Aim to have 3-6 months’ worth of living expenses saved in an emergency fund. This will provide a cushion if you lose your job or face unexpected medical bills.

Reducing Unnecessary Expenses

Identifying and reducing unnecessary expenses can free up significant cash flow. A critical step in managing debt effectively.

- Track Spending:Use a budgeting app or spreadsheet to track your spending habits and identify areas where you can cut back.

- Identify Subscription Services:Review your subscription services, such as streaming platforms, gym memberships, or magazine subscriptions, and cancel those you don’t use regularly.

- Negotiate Bills:Contact your service providers, such as your internet or phone company, to negotiate lower rates or discounts.

- Shop Around for Better Deals:Compare prices for essential goods and services, such as groceries, insurance, and utilities, to find better deals.

Utilizing Budgeting Tools

Budgeting tools, such as apps or spreadsheets, can help you track your spending, identify areas for savings, and stay on top of your finances.

- Budgeting Apps:Popular budgeting apps like Mint, Personal Capital, and YNAB (You Need a Budget) automatically categorize your transactions and provide insights into your spending patterns.

- Spreadsheets:If you prefer a more hands-on approach, you can create a simple budget spreadsheet using Google Sheets or Microsoft Excel.

- 50/30/20 Rule:This popular budgeting method suggests allocating 50% of your income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

Increasing Income

Increasing your income can significantly accelerate your debt repayment journey and improve your overall financial well-being.

- Side Hustle:Explore opportunities for a side hustle, such as freelance writing, driving for a ride-sharing service, or selling crafts online.

- Negotiate a Salary Increase:If you’ve been with your employer for a while and have consistently exceeded expectations, consider negotiating a salary increase.

- Upskill or Reskill:Investing in education or training can enhance your skills and make you more competitive in the job market, potentially leading to higher-paying opportunities.

Preparing for Potential Bankruptcy

If you’ve explored all other debt management options and are considering bankruptcy as a last resort, it’s crucial to understand the process and its implications. Bankruptcy isn’t a decision to be taken lightly, as it has significant legal and financial consequences.

This section will guide you through the different types of bankruptcy, the legal process involved, and factors to consider when making this difficult choice.

Types of Bankruptcy and Their Implications

Bankruptcy proceedings are governed by the U.S. Bankruptcy Code, which Artikels two main types of personal bankruptcy: Chapter 7 and Chapter 13. Understanding the differences between these chapters is crucial for making an informed decision.

- Chapter 7 Bankruptcy: This is often referred to as “liquidation” bankruptcy. In Chapter 7, a court-appointed trustee sells non-exempt assets to repay creditors. This process can result in a complete discharge of most debts, but it also means losing certain assets.

- Chapter 13 Bankruptcy: This is a “reorganization” bankruptcy. Chapter 13 allows individuals with regular income to create a repayment plan, usually lasting three to five years. This plan is submitted to the court and, if approved, allows debtors to make monthly payments to creditors.

While Chapter 13 doesn’t erase all debts, it can help individuals catch up on past-due payments and restructure their debt.

The Legal Process of Filing for Bankruptcy

Filing for bankruptcy is a complex legal process involving multiple steps. The first step is to consult with a qualified bankruptcy attorney. They will help you understand the different types of bankruptcy and advise you on the best course of action.

- Filing a Petition: The bankruptcy attorney will prepare and file a petition with the bankruptcy court, outlining your financial situation and debts.

- Automatic Stay: Once the petition is filed, an automatic stay goes into effect, preventing creditors from contacting you or attempting to collect on your debts.

- Credit Counseling: You must complete a credit counseling course before filing for Chapter 7 bankruptcy.

- Meeting of Creditors: You will attend a meeting with your creditors, where they can ask questions about your financial situation.

- Debt Discharge: After the court approves your bankruptcy plan, most of your debts will be discharged, meaning you are no longer legally obligated to pay them.

Consequences of Filing for Bankruptcy

Bankruptcy has significant consequences, both positive and negative. It can provide relief from overwhelming debt, but it also impacts your credit score and may limit your ability to borrow money in the future.

- Impact on Credit Score: Bankruptcy remains on your credit report for up to 10 years, significantly impacting your credit score. This can make it challenging to obtain loans, mortgages, or even credit cards.

- Potential Job Loss: While employers cannot discriminate against you for filing bankruptcy, some industries might have stricter policies.

- Loss of Assets: In Chapter 7 bankruptcy, you may lose certain assets, such as your home, car, or valuable possessions.

Factors to Consider When Deciding on Bankruptcy

Bankruptcy should be considered a last resort. It’s important to weigh the potential benefits against the drawbacks before making a decision.

- Debt Amount: If your debt is significantly higher than your income, bankruptcy might be the only way to get a fresh start.

- Future Financial Prospects: Consider your income and expenses. Can you realistically repay your debts within a reasonable timeframe?

- Credit Score: Bankruptcy will negatively impact your credit score, making it challenging to access credit in the future.

- Legal Consequences: Bankruptcy has legal implications, such as the potential loss of assets and the impact on your credit report.

Resources for Finding Qualified Bankruptcy Attorneys

If you’re considering bankruptcy, consulting with a qualified bankruptcy attorney is crucial. They can help you navigate the complex legal process and make informed decisions.

- National Association of Consumer Bankruptcy Attorneys (NACBA): NACBA is a professional organization for consumer bankruptcy attorneys. Their website provides a directory of members.

- American Bankruptcy Institute (ABI): ABI is a professional organization for bankruptcy professionals, including attorneys. Their website provides a directory of members.

- Local Bar Association: Contact your local bar association for referrals to qualified bankruptcy attorneys in your area.

Navigating the Legal Process

Filing for bankruptcy is a significant legal process that can feel overwhelming. Having a knowledgeable guide to help you navigate the complexities of the legal system is crucial.

The Role of a Bankruptcy Attorney

A bankruptcy attorney is an essential resource for individuals filing for bankruptcy. They provide expert legal advice and guidance throughout the entire process. They understand the intricacies of bankruptcy laws and procedures, ensuring you comply with all requirements.

- Reviewing your financial situation:Your attorney will thoroughly analyze your financial situation to determine the best course of action. They will consider factors such as your income, expenses, and assets to determine the most suitable type of bankruptcy for your circumstances.

- Preparing and filing bankruptcy paperwork:The bankruptcy process involves completing numerous forms and documents. Your attorney will assist you in preparing and filing these documents accurately and timely, ensuring a smooth and efficient process.

- Negotiating with creditors:Your attorney will work with your creditors to negotiate payment plans or debt reduction options. They will advocate for your interests and strive to achieve the best possible outcome for your financial situation.

- Representing you in court:If necessary, your attorney will represent you in court proceedings, ensuring your rights are protected and that you receive a fair hearing.

Gathering and Organizing Financial Documents

Accurate and complete financial documentation is vital for a successful bankruptcy filing. Your attorney will guide you in gathering and organizing all necessary documents.

- Income verification:This includes pay stubs, tax returns, and any other documentation that demonstrates your income.

- Expense documentation:Gather receipts, bills, and statements for all your expenses, including housing, utilities, transportation, food, and medical expenses.

- Debt documentation:Collect statements, contracts, and any other documents that detail your debts, including the amount owed, interest rates, and the names of creditors.

- Asset documentation:Provide documentation for all your assets, including real estate, vehicles, bank accounts, investments, and personal property.

Preparing for a Meeting with a Bankruptcy Judge

Once you file for bankruptcy, you will be scheduled for a meeting with a bankruptcy judge. This meeting is an opportunity for the judge to review your case and ask questions about your financial situation.

- Review your bankruptcy petition:Carefully review your bankruptcy petition and understand all the information you provided.

- Prepare for questions:Anticipate questions the judge might ask about your income, expenses, debts, and assets.

- Dress appropriately:Dress professionally for the meeting, showing respect for the legal process.

- Be honest and truthful:It is crucial to be honest and truthful in your responses to the judge’s questions.

Steps to Take After Filing for Bankruptcy

After filing for bankruptcy, there are several important steps to take to ensure a smooth process.

- Receive and review court notices:You will receive notices from the court throughout the bankruptcy process. Review these notices carefully and respond promptly to any requests or deadlines.

- Attend court hearings:If required, attend any court hearings related to your bankruptcy case.

- Contact creditors:Notify your creditors that you have filed for bankruptcy.

- Update your credit report:Your bankruptcy filing will be reflected on your credit report.

- Create a new budget:After bankruptcy, it is essential to create a new budget that helps you manage your finances effectively and avoid future debt.

Rebuilding Your Credit After Bankruptcy

Bankruptcy can have a significant impact on your credit score, making it challenging to access credit in the future. However, rebuilding your credit is possible with time, effort, and responsible financial management.

Understanding the Impact of Bankruptcy on Credit

Bankruptcy remains on your credit report for 10 years, significantly lowering your credit score. This makes it difficult to secure loans, credit cards, or even rent an apartment. Lenders view bankruptcy as a sign of financial instability and may be hesitant to extend credit.

Steps to Rebuild Credit After Bankruptcy

Rebuilding your credit requires patience and a strategic approach. Here are some essential steps:

Paying Bills on Time

Maintaining a positive payment history is crucial for rebuilding your credit. Make all your payments on time, including utility bills, rent, and any outstanding debts. Consistent on-time payments demonstrate your financial responsibility to lenders.

Obtaining New Credit

After bankruptcy, obtaining new credit can be challenging. However, some options are available:

- Secured Credit Cards:These cards require a security deposit, which acts as collateral. This reduces the lender’s risk, making it easier to obtain credit. Responsible use of a secured credit card can help rebuild your credit score.

- Credit Builder Loans:These loans are designed specifically for individuals with limited credit history. The loan amount is typically small, and the lender reports your payment history to credit bureaus, helping you establish positive credit.

- Becoming an Authorized User:If you have a close friend or family member with good credit, you may be able to become an authorized user on their credit card. This can help you benefit from their positive credit history, but ensure you understand the responsibilities involved.

Managing Credit Responsibly

Once you have established new credit, it is crucial to manage it responsibly:

- Keep Balances Low:Aim to keep your credit utilization ratio (the amount of credit used compared to your available credit limit) below 30%. High credit utilization can negatively impact your credit score.

- Avoid Opening Too Many Accounts:Opening multiple credit accounts simultaneously can lower your credit score. Focus on managing existing accounts responsibly before applying for new ones.

- Monitor Your Credit Report:Regularly check your credit report for errors or inconsistencies. You can access your credit report for free from all three major credit bureaus: Experian, Equifax, and TransUnion.

Strategies for Obtaining New Credit After Bankruptcy

Securing new credit after bankruptcy can be challenging, but there are strategies you can employ:

- Start with a Secured Credit Card:Secured credit cards require a security deposit, making them easier to obtain. This deposit is typically equal to your credit limit, which is usually smaller than unsecured cards. Responsible use of a secured card can help rebuild your credit history.

- Consider a Credit Builder Loan:These loans are designed for individuals with limited credit history. They often have lower loan amounts and are reported to credit bureaus, helping you establish positive credit.

- Become an Authorized User:If you have a close friend or family member with good credit, becoming an authorized user on their credit card can help improve your credit score. However, ensure you understand the responsibilities involved and that the card is used responsibly.

Related Terms and Concepts

Understanding the terminology and concepts related to debt management and bankruptcy is crucial for making informed decisions. This section explores various terms and concepts, providing insights into their significance in the context of financial health and debt resolution.

Finance

Personal finance encompasses managing your money, including income, expenses, savings, and investments. It plays a vital role in debt management by helping you understand your financial situation, create a budget, track spending, and develop strategies for paying off debt.

Auto Loans

Auto loans are secured loans used to finance the purchase of a vehicle. Obtaining the best auto loan rates and terms is essential. Shopping around for loans from different lenders, comparing interest rates, and negotiating loan terms can significantly impact the total cost of the vehicle.

Bankruptcy Lawyers

Navigating the complexities of bankruptcy law can be overwhelming. A bankruptcy lawyer provides legal guidance and representation throughout the bankruptcy process, ensuring your rights are protected and the process is handled correctly.

Bankruptcy Medical

Medical debt is a significant factor in many bankruptcy filings. Medical expenses can quickly accumulate, leading to overwhelming debt. Bankruptcy can provide relief from medical debt, allowing individuals to start fresh financially.

Bankruptcy Personal

Bankruptcy allows for the discharge of certain types of personal debt. Common types of personal debt that can be discharged through bankruptcy include credit card debt, unsecured loans, and certain types of medical debt.

Bankruptcy Tips Advice

Managing debt effectively and preparing for potential bankruptcy requires careful planning and action.

- Create a budget to track income and expenses.

- Contact creditors to negotiate payment plans.

- Consider debt consolidation or debt management programs.

- Seek legal advice from a bankruptcy attorney.

Credit Counseling

Credit counseling agencies provide guidance and support to individuals struggling with debt. They can help develop a budget, negotiate with creditors, and explore debt management options, such as debt consolidation or debt management plans.

Credit Tips

Building and maintaining good credit is essential for accessing affordable loans and financial products.

- Pay bills on time.

- Keep credit utilization low.

- Monitor credit reports regularly.

- Consider a secured credit card to build credit.

Currency Trading

Currency trading involves buying and selling currencies to profit from fluctuations in exchange rates. It can be a high-risk investment, and it is important to understand the complexities and potential risks before engaging in currency trading.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify debt management and potentially reduce monthly payments. However, it is important to consider the potential drawbacks, such as higher overall interest charges if the loan term is extended.

Debt Management

Debt management encompasses strategies for controlling and reducing debt. This includes budgeting, prioritizing debt payments, negotiating with creditors, and exploring debt relief options.

Debt Relief

Debt relief options provide individuals with various ways to reduce or eliminate debt. Bankruptcy is one form of debt relief, while others include debt consolidation, debt management plans, and debt settlement.

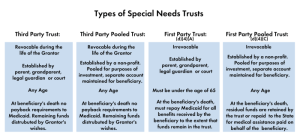

Estate Plan Trusts

Estate planning involves creating a plan for managing your assets and finances after your death. Trusts are legal arrangements that can protect assets and minimize debt.

Home Equity Loans

Home equity loans use the equity in your home as collateral. They can be used to consolidate debt, but it is essential to consider the risks. If you default on the loan, you could lose your home.

Last Recap

Managing debt effectively is a journey that requires commitment, discipline, and a proactive approach. By understanding your debt situation, exploring available options, and improving your financial habits, you can increase your chances of overcoming debt and achieving financial stability. Remember, seeking professional guidance from a credit counselor or bankruptcy attorney can provide valuable support and direction throughout this process.

While bankruptcy may seem like a daunting prospect, it’s important to remember that it can be a path to a fresh start, allowing you to rebuild your financial life and move forward with a brighter future.

FAQ Guide

What are the common signs that I might need to consider bankruptcy?

If you’re consistently struggling to make minimum payments on your debts, receiving numerous collection calls, or facing legal action from creditors, it’s a sign that you might need to explore bankruptcy as an option.

How long does it take to file for bankruptcy?

The time it takes to file for bankruptcy varies depending on the type of bankruptcy, your individual circumstances, and the complexity of your case. However, the process generally takes several months.

What happens to my assets after filing for bankruptcy?

The type of bankruptcy you file for determines how your assets are treated. Chapter 7 bankruptcy typically involves liquidating certain assets to pay off creditors, while Chapter 13 bankruptcy allows you to keep your assets while repaying debts over a set period.

Can I file for bankruptcy if I have a mortgage?

Yes, you can file for bankruptcy even if you have a mortgage. However, bankruptcy may affect your mortgage payments, and you may need to work with your lender to modify your loan terms.

How can I rebuild my credit after bankruptcy?

Rebuilding your credit after bankruptcy requires time and effort. You can start by paying your bills on time, establishing a positive payment history, and exploring options like secured credit cards to rebuild your credit score.