Navigating the world of debt can feel overwhelming, but it doesn’t have to be. Whether you’re just starting out on your financial journey or seeking to refine your debt management skills, there are countless resources available to empower you to take control of your finances.

From budgeting basics to sophisticated debt consolidation strategies, the right knowledge can pave the way to financial freedom.

This comprehensive guide delves into the intricacies of debt management, exploring various techniques, strategies, and tools to help you make informed decisions and achieve your financial goals. We’ll cover everything from creating a personalized budget to understanding the nuances of debt consolidation and exploring the role of credit counseling and debt relief programs.

Understanding Debt Management

Debt management is the process of taking control of your finances by strategically planning how to pay off your debts. It’s an essential aspect of personal finance, as it can significantly impact your financial well-being and future financial goals. Effective debt management can help you reduce interest payments, improve your credit score, and achieve financial freedom.

Debt Management Techniques

Debt management techniques are strategies used to effectively manage and pay off debt. These techniques can help individuals reduce their debt burden, improve their financial situation, and build a stronger financial future. There are several common debt management techniques, each with its advantages and disadvantages:

Budgeting

Budgeting is the foundation of effective debt management. It involves tracking your income and expenses to understand your spending habits and identify areas where you can cut back. By creating a budget, you can allocate funds for debt repayment, prioritize essential expenses, and reduce unnecessary spending.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your debt repayment process and potentially save you money on interest charges. However, it’s crucial to ensure the new loan’s terms are favorable and that you can afford the monthly payments.

Debt Snowball Method

The debt snowball method focuses on paying off the smallest debt first, regardless of the interest rate. This method can provide a sense of accomplishment and motivation as you quickly eliminate debts. However, it may take longer to pay off high-interest debts and result in higher overall interest payments.

Debt Avalanche Method

The debt avalanche method prioritizes paying off debts with the highest interest rates first. This method minimizes the total interest paid over time, but it can be challenging to stay motivated as you may initially make smaller payments on larger debts.

Budgeting and Tracking Expenses

Creating a budget and tracking your expenses are crucial steps in managing your debt effectively. By understanding where your money is going, you can identify areas where you can cut back and allocate funds towards paying down your debt.

Creating a Realistic Budget

A realistic budget considers all your income and expenses, ensuring that your spending aligns with your financial goals. Here’s a step-by-step guide:

1. Track Your Income

- List all your income sources, including your salary, part-time jobs, investments, and any other regular income streams.

- Calculate your net income after taxes and deductions.

2. Categorize Your Expenses

- Keep a record of all your expenses for a month, categorizing them into essential and non-essential expenses.

- Essential expenses include housing, utilities, groceries, transportation, and healthcare.

- Non-essential expenses include entertainment, dining out, subscriptions, and shopping.

3. Create a Budget Template

- Use a spreadsheet or budgeting app to create a budget template.

- List your income and expenses under their respective categories.

- Allocate a specific amount for each category, ensuring that your total expenses do not exceed your income.

4. Adjust Your Budget

- Review your budget regularly and make adjustments as needed.

- Prioritize essential expenses and look for areas where you can cut back on non-essential expenses.

- Be flexible and adjust your budget based on changes in your income or expenses.

Tracking Expenses Effectively

Tracking your expenses helps you stay accountable to your budget and identify areas where you can save money. Here are some effective methods:

1. Use Budgeting Apps

- Budgeting apps automatically track your expenses and categorize them.

- They provide insights into your spending habits and offer personalized recommendations.

- Popular budgeting apps include Mint, Personal Capital, and YNAB (You Need a Budget).

2. Utilize Spreadsheets

- Create a simple spreadsheet to track your expenses manually.

- Use formulas to calculate your monthly spending and identify areas where you can cut back.

- Spreadsheets provide flexibility and customization options.

3. Track Expenses in a Journal

- Maintain a physical journal to record your expenses.

- Categorize your expenses and review them periodically to identify spending patterns.

- This method promotes mindfulness and helps you become more aware of your spending habits.

Setting Financial Goals

Setting clear financial goals is essential for motivating yourself and staying on track with your budget.

1. Define Your Goals

- Determine your short-term and long-term financial goals, such as paying off debt, saving for a down payment on a house, or investing for retirement.

- Be specific and measurable with your goals.

2. Align Your Budget with Your Goals

- Prioritize your goals and allocate funds accordingly.

- Adjust your budget to ensure that you are making progress towards your financial goals.

Debt Consolidation and Refinancing

Debt consolidation is a strategy that combines multiple debts into a single loan with a lower interest rate. This can simplify your payments and potentially reduce your overall interest costs.

Types of Debt Consolidation Loans

Debt consolidation loans can come in various forms, each with its own set of terms and conditions. Understanding the different types of loans can help you choose the best option for your situation.

- Balance Transfer Credit Cards:These cards offer a temporary 0% introductory APR for a specified period, allowing you to transfer balances from other high-interest credit cards. However, once the introductory period ends, the interest rate typically jumps to a higher level.

- Personal Loans:Personal loans can be used to consolidate various types of debt, including credit cards, medical bills, and payday loans. They often have fixed interest rates, which can provide stability and predictability in your monthly payments.

- Home Equity Loans:These loans use your home’s equity as collateral. They typically offer lower interest rates than unsecured loans, but they come with the risk of losing your home if you default on the loan.

Evaluating Debt Consolidation Options

Choosing the right debt consolidation option requires careful consideration of your financial situation and goals.

- Interest Rates:Compare the interest rates offered by different lenders and choose the one with the lowest rate.

- Loan Terms:Pay attention to the loan term (the length of time you have to repay the loan). Longer terms may result in lower monthly payments, but you’ll pay more in interest over the life of the loan.

- Fees:Be aware of any fees associated with the loan, such as origination fees, application fees, or prepayment penalties.

- Credit Score:Your credit score will significantly impact the interest rate and loan terms you qualify for. A higher credit score will generally lead to better loan offers.

Credit Counseling and Debt Relief

When faced with overwhelming debt, seeking professional guidance can be a crucial step towards financial recovery. Credit counseling agencies and debt relief programs offer valuable resources and strategies to help individuals navigate their financial challenges.

Credit Counseling Agencies

Credit counseling agencies play a vital role in helping individuals manage their debt effectively. These agencies provide non-profit, unbiased advice and support to individuals struggling with debt. Credit counselors can help individuals:

- Develop a personalized budget:Counselors help individuals track their income and expenses, identify areas for potential savings, and create a realistic budget that aligns with their financial goals.

- Negotiate with creditors:Counselors can act as intermediaries between individuals and their creditors, negotiating lower interest rates, payment plans, or even debt forgiveness in certain cases.

- Explore debt consolidation options:Counselors can help individuals understand different debt consolidation options, such as debt consolidation loans or balance transfers, and determine if these options are suitable for their situation.

- Access educational resources:Credit counseling agencies offer educational materials and workshops on topics related to debt management, financial literacy, and responsible credit use.

Debt Relief Programs

Debt relief programs are designed to assist individuals in reducing their debt burden. These programs typically involve working with a debt relief company or agency to negotiate with creditors on behalf of the individual.

Debt Settlement

Debt settlement programs aim to negotiate with creditors to reduce the amount of debt owed. These programs typically involve setting up a separate account where individuals make monthly payments. The debt settlement company then uses these funds to negotiate lower settlements with creditors.Debt settlement can be a viable option for individuals who:

- Are unable to make their current debt payments.

- Have a significant amount of unsecured debt, such as credit card debt or medical bills.

Bankruptcy

Bankruptcy is a legal process that allows individuals to discharge certain debts or restructure their finances. There are two main types of bankruptcy: Chapter 7 and Chapter 13.

- Chapter 7 Bankruptcy:This type of bankruptcy involves liquidating assets to pay off creditors. After the assets are sold, remaining debts are discharged. This option is typically used for individuals with limited assets and significant debt.

- Chapter 13 Bankruptcy:This type of bankruptcy involves creating a repayment plan for creditors over a period of three to five years. The plan is court-approved, and individuals make payments to a trustee who distributes the funds to creditors. This option is typically used for individuals who want to keep their assets and have a steady income.

Pros and Cons of Seeking Professional Debt Relief Assistance

Pros:

- Negotiating power:Debt relief companies and agencies often have greater negotiating power with creditors than individuals, as they handle a large volume of debt cases.

- Professional guidance:Debt relief professionals can provide individuals with personalized advice and support, helping them navigate the complex process of debt management.

- Time-saving:Debt relief companies handle the communication and negotiation with creditors, freeing up individuals to focus on other aspects of their lives.

Cons:

- Fees:Debt relief companies typically charge fees for their services, which can vary depending on the program and the amount of debt being settled.

- Negative impact on credit score:Debt settlement programs can negatively impact credit scores, as they involve negotiating with creditors for lower settlements, which may be reported to credit bureaus as “settled” accounts.

- Potential for scams:Not all debt relief companies are legitimate, and some may engage in unethical or illegal practices. It is important to research and choose a reputable company.

Avoiding Debt Traps and Building Financial Stability

Learning about debt management is crucial, but it’s equally important to understand how to avoid falling into debt traps in the first place. By understanding common pitfalls and developing healthy financial habits, you can build a strong financial foundation and avoid the stress and burden of overwhelming debt.

Identifying Common Debt Traps

Debt traps are situations that can lead to a cycle of borrowing and spending that’s difficult to escape. Understanding these traps is the first step in avoiding them.

- Payday Loans:These high-interest loans are marketed as quick solutions for short-term financial needs. However, their exorbitant interest rates and fees can quickly spiral into a cycle of debt.

- Credit Card Debt:While credit cards offer convenience and rewards, they can lead to debt if not used responsibly. High interest rates and minimum payments can make it challenging to pay off balances, leading to accumulating interest and fees.

- Predatory Lending Practices:Some lenders target vulnerable individuals with unfair or deceptive loan terms, such as high interest rates, hidden fees, and aggressive collection tactics. Be cautious of lenders who pressure you into making quick decisions or who offer loans with unclear terms.

Strategies for Avoiding Debt Traps

Taking proactive steps to manage your finances and avoid debt traps is essential for building financial stability. Here are some key strategies:

- Create and Stick to a Budget:A budget helps you track your income and expenses, allowing you to identify areas where you can cut back and save.

- Build an Emergency Fund:Having an emergency fund can prevent you from relying on high-interest loans when unexpected expenses arise. Aim to save 3-6 months’ worth of living expenses.

- Avoid Unnecessary Spending:Before making a purchase, ask yourself if it’s a need or a want. Consider delaying gratification and prioritizing essential expenses.

- Use Credit Cards Wisely:Only use credit cards for purchases you can afford to pay off in full each month. Avoid carrying a balance, as this can lead to accumulating interest.

- Shop Around for Loans:Compare interest rates and terms from different lenders before taking out a loan. Choose the option with the lowest interest rate and fees.

- Be Wary of Predatory Lenders:Research lenders thoroughly and avoid those with unclear terms, high interest rates, or aggressive collection practices.

Establishing Good Credit Habits

A good credit score is essential for accessing loans and credit cards at favorable rates. Here’s how to build and maintain a strong credit history:

- Pay Bills on Time:Paying bills on time is the most important factor in building credit. Set reminders or use automatic payments to ensure timely payments.

- Keep Credit Utilization Low:Credit utilization ratio is the amount of credit you’re using compared to your total credit limit. Aim to keep it below 30%.

- Diversify Credit:Having a mix of different credit accounts, such as credit cards and loans, can positively impact your credit score.

- Monitor Your Credit Report:Check your credit report regularly for errors or fraudulent activity. You can obtain a free copy of your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) annually at AnnualCreditReport.com.

Related Financial Topics

Understanding and managing debt effectively is an essential part of personal finance. However, debt management is not an isolated concept. It is intertwined with various other financial topics that impact your overall financial well-being. This section will explore some related financial topics, providing insights and resources to help you navigate your financial journey.

Financial Literacy

Financial literacy is crucial for making informed decisions about money, including debt management. It empowers you to understand financial concepts, manage your finances effectively, and make sound financial choices.

- Understanding Budgeting:A budget helps you track your income and expenses, identify areas for savings, and allocate funds effectively.

- Learning about Investing:Investing allows your money to grow over time, potentially exceeding inflation.

- Knowing Your Credit Score:Your credit score reflects your creditworthiness and impacts your ability to access loans and credit cards.

- Understanding Financial Products:Becoming familiar with different financial products like savings accounts, checking accounts, loans, and insurance helps you make informed choices based on your needs.

Auto Loans

Auto loans are a common form of financing for purchasing a car. Understanding the different types of auto loans, their associated interest rates, and factors influencing the loan terms is crucial for securing a favorable deal.

- Types of Auto Loans:Auto loans can be categorized as new car loans, used car loans, and private auto loans, each with varying interest rates.

- Factors Influencing Loan Terms:Factors such as loan term, down payment, and credit score significantly impact the interest rate and overall cost of the loan.

- Tips for Getting the Best Deal:Researching loan options, comparing interest rates, and negotiating with lenders can help you secure the best deal on an auto loan.

Bankruptcy Lawyers

Bankruptcy is a legal process that allows individuals to discharge or restructure their debts under court supervision. A bankruptcy lawyer plays a vital role in guiding individuals through this complex process.

- Role of Bankruptcy Lawyers:Bankruptcy lawyers provide legal advice, file necessary paperwork, and represent individuals in bankruptcy court proceedings.

- Types of Bankruptcy Filings:The two main types of bankruptcy filings are Chapter 7 (liquidation) and Chapter 13 (reorganization), each with specific eligibility requirements and consequences.

- Choosing a Qualified Lawyer:Selecting a qualified bankruptcy lawyer with experience and a good track record is crucial for navigating the process effectively.

Bankruptcy Medical

Medical debt is a growing concern for many individuals, often leading to financial hardship and even bankruptcy. Understanding the impact of medical debt on financial well-being is essential.

- Challenges of Medical Debt:Medical debt can be overwhelming due to high costs, unexpected bills, and complex billing procedures.

- Impact on Credit Score and Future Borrowing:Medical debt can significantly damage your credit score, making it difficult to obtain loans or credit cards in the future.

- Managing Medical Debt:Negotiating with medical providers, exploring payment plans, and seeking assistance from non-profit organizations can help manage medical debt.

Bankruptcy Personal

Personal bankruptcy is a legal process that allows individuals to eliminate or restructure their debts. Understanding the different types of personal bankruptcy filings and their implications is essential.

- Chapter 7 Bankruptcy:Chapter 7 bankruptcy involves liquidating assets to repay creditors.

- Chapter 13 Bankruptcy:Chapter 13 bankruptcy allows individuals to create a repayment plan to pay off debts over a period of three to five years.

- Eligibility Requirements:Each type of bankruptcy has specific eligibility requirements based on income, assets, and debt levels.

- Consequences of Filing:Filing for bankruptcy has significant consequences, including a negative impact on credit score, potential asset loss, and limitations on future borrowing.

Bankruptcy Tips Advice

Bankruptcy is a serious decision with significant consequences. Seeking professional legal advice and exploring alternative debt relief options before filing is crucial.

- Seek Professional Legal Advice:Consulting with a qualified bankruptcy lawyer is essential to understand your options and the implications of filing.

- Explore Alternative Debt Relief Options:Options like debt consolidation, credit counseling, and debt settlement programs may be viable alternatives to bankruptcy.

- Consider the Long-Term Impact:Bankruptcy can have lasting consequences on your credit score and financial well-being.

Credit Counseling

Credit counseling agencies provide guidance and support to individuals struggling with debt. They offer various services to help manage debt effectively.

- Role of Credit Counseling Agencies:Credit counseling agencies provide education, budgeting assistance, and debt management strategies.

- Types of Credit Counseling Services:Credit counseling services include debt management plans, credit score improvement strategies, and financial education workshops.

- Finding a Reputable Agency:Choosing a reputable credit counseling agency accredited by a reputable organization is essential.

Credit Tips

Building good credit habits and improving your credit score can significantly impact your financial well-being.

- Pay Bills on Time:Making timely payments is crucial for maintaining a good credit score.

- Manage Credit Card Usage:Keeping credit card balances low and avoiding excessive debt is essential for good credit.

- Monitor Credit Reports:Regularly checking your credit reports for errors and ensuring accuracy is vital.

- Dispute Errors:If you discover errors on your credit report, take steps to dispute them with the credit bureaus.

Currency Trading

Currency trading involves buying and selling currencies in the foreign exchange market. It can be a complex and risky endeavor.

- Basics of Currency Trading:Currency trading involves speculating on currency fluctuations to profit from price differences.

- Risks and Rewards:Currency trading offers potential for high returns but also carries significant risks, including market volatility and potential losses.

- Tips for Beginners:Start with a small investment, educate yourself about the market, and consider using a reputable trading platform.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can help reduce monthly payments and simplify debt management.

- Process of Debt Consolidation:Debt consolidation involves taking out a new loan to pay off existing debts.

- Types of Debt Consolidation Loans:Debt consolidation loans can be secured or unsecured, with varying interest rates and terms.

- Evaluating Debt Consolidation Options:Carefully evaluate different debt consolidation options, including interest rates, loan terms, and fees.

Debt Management

Debt management involves implementing strategies to control debt levels, reduce monthly payments, and eventually become debt-free.

- Budgeting:Creating and sticking to a budget is essential for managing debt effectively.

- Debt Consolidation:Combining multiple debts into a single loan can simplify debt management and reduce interest costs.

- Debt Snowball Method:The debt snowball method involves paying off debts from smallest to largest, providing a sense of accomplishment and motivation.

- Debt Avalanche Method:The debt avalanche method prioritizes paying off debts with the highest interest rates first, minimizing overall interest costs.

Debt Relief

Debt relief programs offer assistance to individuals struggling with overwhelming debt. These programs aim to reduce debt burden and improve financial stability.

- Types of Debt Relief Programs:Debt relief programs include debt settlement, bankruptcy, and credit counseling.

- Pros and Cons of Professional Debt Relief:Professional debt relief agencies can provide guidance and negotiation expertise but may involve fees and potential risks.

- Choosing a Reputable Agency:Researching and selecting a reputable debt relief agency with a good track record is crucial.

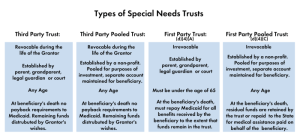

Estate Plan Trusts

Estate planning involves preparing for the distribution of your assets after your death. Trusts can play a crucial role in protecting assets and ensuring your wishes are fulfilled.

- Importance of Estate Planning:Estate planning ensures your assets are distributed according to your wishes and protects your loved ones from financial hardship.

- Types of Trusts:Different types of trusts, such as living trusts and testamentary trusts, offer various benefits for asset protection and distribution.

- Creating a Comprehensive Estate Plan:Consulting with an estate planning attorney is essential to create a comprehensive plan that meets your individual needs.

Home Equity Loans

Home equity loans allow homeowners to borrow against the equity they have built in their homes.

- Basics of Home Equity Loans:Home equity loans are secured loans, meaning the borrower’s home serves as collateral.

- Risks and Benefits:Home equity loans offer lower interest rates than unsecured loans but carry the risk of foreclosure if the borrower defaults.

- Obtaining a Home Equity Loan:To obtain a home equity loan, borrowers must have sufficient equity in their homes and meet lender requirements.

End of Discussion

Taking charge of your debt is a journey that requires dedication, knowledge, and the right resources. By understanding the different debt management techniques available, you can choose the approach that best suits your individual circumstances and embark on a path towards financial stability.

Remember, the key to successful debt management lies in proactive planning, consistent effort, and a commitment to building a brighter financial future.

FAQ Summary

What are some common debt traps to avoid?

Payday loans, high-interest credit card debt, and predatory lending practices are common debt traps to watch out for. These often come with exorbitant fees and interest rates, making it difficult to escape the cycle of debt.

How can I improve my credit score?

Pay bills on time, keep credit card balances low, avoid opening too many new accounts, and monitor your credit report regularly for errors. These habits contribute to a healthy credit score.

What are some good resources for learning more about debt management?

Reputable websites like NerdWallet, Investopedia, and the Consumer Financial Protection Bureau (CFPB) offer valuable information and tools for managing debt effectively. Local credit counseling agencies and financial advisors can also provide personalized guidance.