Navigating the world of estate planning can be complex, especially when it comes to safeguarding the future of individuals with special needs. Traditional estate planning strategies often fall short in protecting government benefits and ensuring long-term financial security for those with disabilities.

This is where special needs trusts come into play, offering a crucial tool for families to navigate the unique challenges of planning for a loved one’s well-being.

This comprehensive guide explores the intricacies of special needs trusts, demystifying their purpose, benefits, and essential considerations. We’ll delve into different trust structures, key provisions, and the critical role of legal and financial expertise in creating a robust estate plan that effectively addresses the specific needs of individuals with disabilities.

Understanding Special Needs Trusts

A special needs trust is a legal tool designed to help individuals with disabilities manage their finances while protecting their eligibility for government benefits. These trusts are crucial for individuals with special needs who may receive benefits like Supplemental Security Income (SSI) or Medicaid.

Types of Special Needs Trusts

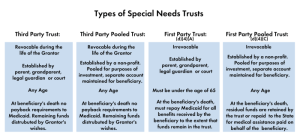

Special needs trusts come in different forms, each serving a specific purpose. Here are the two most common types:

- Supplemental Needs Trust (SNT):This type of trust is created by an individual or their family. It allows the beneficiary to receive supplemental funds, such as for housing, education, or personal care, without jeopardizing their eligibility for government benefits.

- Pooled Trust:This type of trust is managed by a non-profit organization and allows individuals to pool their assets for investment purposes.

It offers advantages like professional management and potential tax benefits.

Examples of How Special Needs Trusts Protect Government Benefits

Special needs trusts work by ensuring that the beneficiary’s assets are managed separately from their government benefits. This separation prevents the government from considering the trust assets as the beneficiary’s own, which could lead to a reduction or termination of their benefits.

For example, if an individual with disabilities receives SSI and inherits a substantial amount of money, this inheritance could potentially disqualify them from receiving SSI benefits. However, if the inheritance is placed in a special needs trust, the government will not consider it as part of the individual’s assets, thus preserving their eligibility for SSI.

Benefits of Estate Planning for Individuals with Special Needs

Estate planning for individuals with special needs is essential for ensuring their financial security and long-term care. It involves creating a comprehensive plan that addresses their unique needs and protects their future. By proactively planning, families can alleviate potential financial burdens and ensure their loved ones receive the care and support they need throughout their lives.

Financial Security and Long-Term Care

A well-structured estate plan can provide individuals with special needs with financial security and long-term care. It safeguards their assets and ensures they have the resources necessary to meet their ongoing needs. Here’s how:

- Protection of Government Benefits:Individuals with special needs often rely on government benefits such as Supplemental Security Income (SSI) and Medicaid. Estate planning can help preserve these benefits by establishing a Special Needs Trust. This trust allows individuals to receive additional financial support without jeopardizing their eligibility for government assistance.

- Long-Term Care Planning:Estate planning can address the long-term care needs of individuals with special needs. It can include provisions for funding their housing, medical expenses, and other essential services. This can help ensure they receive quality care in a setting that meets their individual needs.

- Financial Management:Estate planning can appoint a trusted individual as a guardian or conservator to manage the individual’s finances. This ensures their funds are used responsibly and that they have access to the resources they need.

Challenges Without Proper Estate Planning

Without proper estate planning, individuals with special needs and their families may face significant challenges. These challenges can include:

- Loss of Government Benefits:If an individual with special needs inherits assets directly, they may lose their eligibility for government benefits. This can result in a substantial loss of income and financial support.

- Financial Mismanagement:Without a designated guardian or conservator, an individual’s assets may be mismanaged or depleted, leaving them vulnerable and unable to meet their needs.

- Lack of Long-Term Care Planning:Without a plan in place, families may struggle to provide the necessary care and support for their loved ones. This can lead to financial strain, emotional stress, and uncertainty about the individual’s future.

Key Considerations for Trust Structures

Choosing the right trust structure is crucial for ensuring your loved one’s financial security and well-being. Different trust structures offer varying levels of protection and flexibility, making it essential to select one that aligns with your individual needs and circumstances.

Factors to Consider When Selecting a Trust Structure

It’s crucial to carefully consider several factors when choosing a trust structure for special needs planning. These factors can help you determine the most suitable option for your loved one’s specific needs and circumstances.

- Age:The age of the beneficiary can influence the type of trust that is most appropriate. For instance, a younger beneficiary may benefit from a trust that provides for their needs until they reach a certain age, while an older beneficiary may need a trust that offers more flexibility and control over their assets.

- Financial Resources:The amount of financial resources available for the trust can also play a role in determining the best structure. If the resources are limited, a simpler trust may be more suitable. Conversely, a more complex trust structure may be necessary to manage larger assets and ensure their long-term preservation.

- Government Benefits:It is crucial to consider the impact of the trust on government benefits, such as Supplemental Security Income (SSI) and Medicaid. Some trust structures can jeopardize eligibility for these benefits, while others are designed to preserve them. For example, a Supplemental Needs Trust(SNT) is specifically designed to protect government benefits by ensuring that the trust’s assets are not considered part of the beneficiary’s countable resources.

- Other Considerations:Other factors to consider include the beneficiary’s health, their ability to manage their own finances, and the level of control you desire over the trust’s assets. For example, if the beneficiary has significant health issues, a trust that provides for their medical expenses may be necessary.

If the beneficiary has limited financial literacy, a trust that provides for their financial management may be beneficial.

Essential Provisions for Special Needs Trusts

A Special Needs Trust (SNT) is a powerful tool for safeguarding the financial well-being of individuals with disabilities and ensuring they receive the care and support they need. It’s crucial to carefully consider the specific needs of the beneficiary and the goals of the trust when drafting the trust document.

Essential Provisions for Special Needs Trusts

To ensure the trust effectively meets the beneficiary’s needs, several essential provisions should be included.

- Definition of “Special Needs”:Clearly define what constitutes “special needs” for the beneficiary. This clarifies what expenses the trust can cover. For example, it may include medical care, housing, education, transportation, and personal care.

- Beneficiary’s Rights and Responsibilities:Artikel the beneficiary’s rights and responsibilities under the trust. For instance, the beneficiary may have the right to receive information about the trust’s assets and distributions, while also having responsibilities, such as providing updates on their needs and cooperating with the trustee.

- Trustee’s Powers and Responsibilities:Clearly define the trustee’s powers and responsibilities, such as managing trust assets, making distributions, and providing for the beneficiary’s needs. It should also Artikel how the trustee is to be compensated for their services.

- Distribution Guidelines:Establish clear guidelines for distributing trust funds. This should specify the purposes for which funds can be used, such as paying for medical expenses, housing, or education. It should also Artikel the process for requesting and approving distributions.

- Protection from Medicaid Spend-Down:Ensure the trust is structured to comply with Medicaid eligibility rules. This often involves limiting the amount of assets the beneficiary can access to prevent them from exceeding Medicaid’s asset limit and jeopardizing their eligibility for benefits.

- Succession Planning:Artikel the plan for the trust’s assets if the beneficiary dies. This could involve naming a successor trustee and specifying how the remaining assets should be distributed.

- Amendment and Termination Provisions:Include provisions for amending or terminating the trust, outlining the process for making changes and the conditions under which the trust can be terminated.

Sample Trust Document

A sample trust document could include the following key clauses:

Article I: Purpose and DefinitionsThis Special Needs Trust is established for the benefit of [Beneficiary’s Name], an individual with special needs. “Special Needs” shall mean any expenses related to [Beneficiary’s Name]’s disability, including but not limited to medical care, housing, education, transportation, and personal care.

Article II: Trustee’s Powers and ResponsibilitiesThe Trustee shall have the power to manage the Trust’s assets, make distributions to the Beneficiary for their special needs, and provide for their care and well-being. The Trustee shall act in the Beneficiary’s best interests and shall not be personally liable for any losses incurred in the administration of the Trust, provided that the Trustee acted in good faith and with reasonable care.

Article III: Distribution of Trust FundsThe Trustee shall distribute Trust funds to the Beneficiary for their special needs as determined by the Trustee. The Trustee shall prioritize distributions for essential needs, such as medical care, housing, and food. Distributions for non-essential needs, such as entertainment or travel, may be made at the Trustee’s discretion.

Article IV: Medicaid Spend-Down ProtectionThe Trustee shall manage the Trust’s assets in a manner that does not jeopardize the Beneficiary’s eligibility for Medicaid benefits. The Trustee shall ensure that the Beneficiary’s assets do not exceed the Medicaid asset limit.

Role of the Trustee

The trustee plays a crucial role in managing the SNT and ensuring the beneficiary’s needs are met. They have several key responsibilities:

- Manage Trust Assets:The trustee is responsible for managing the trust’s assets, including investing, selling, and reinvesting funds to ensure the trust’s growth and stability.

- Make Distributions:The trustee makes decisions about distributing trust funds to the beneficiary for their special needs, ensuring the funds are used appropriately and ethically.

- Provide for the Beneficiary’s Needs:The trustee is responsible for providing for the beneficiary’s care and well-being, which may include coordinating medical care, arranging for housing, and ensuring the beneficiary’s safety and security.

- Maintain Trust Records:The trustee must keep accurate and detailed records of all trust transactions, including income, expenses, distributions, and asset holdings. This ensures transparency and accountability.

- Comply with Legal Requirements:The trustee must comply with all applicable laws and regulations related to special needs trusts, including tax reporting requirements and Medicaid eligibility rules.

Tax Implications and Legal Considerations

Special needs trusts have unique tax implications and legal requirements that are crucial to understand for effective estate planning. This section will discuss the tax implications of special needs trusts, highlight the legal requirements for establishing a trust, and provide guidance on seeking legal advice from qualified estate planning attorneys.

Tax Implications of Special Needs Trusts

Special needs trusts are designed to protect government benefits, and they are typically established as supplemental needs trusts (SNTs). These trusts allow individuals with disabilities to receive additional income and assets without jeopardizing their eligibility for government benefits like Medicaid, Supplemental Security Income (SSI), and other needs-based programs.

- Income Taxation:The income generated by a special needs trust is generally taxed at the trust’s own tax rate, which is typically the same as the beneficiary’s tax rate. However, if the trust is classified as a complex trust, the income might be taxed at the trust’s rate and then distributed to the beneficiary.

- Principal Taxation:The principal of a special needs trust is generally not taxed until it is distributed to the beneficiary.

- Estate Taxation:Upon the beneficiary’s death, the remaining assets in the trust are typically included in the beneficiary’s estate for federal estate tax purposes. However, there are exceptions, such as the “first-to-die” rule, which can help minimize estate taxes.

Legal Requirements for Establishing a Trust

Establishing a special needs trust requires careful planning and adherence to specific legal requirements. These requirements vary depending on the state, and it is essential to consult with a qualified estate planning attorney.

- Trust Agreement:A well-drafted trust agreement is essential for defining the trust’s purpose, beneficiaries, trustee responsibilities, and distribution guidelines.

- State Laws:Each state has its own laws regarding special needs trusts, including specific requirements for their creation, operation, and administration.

- Beneficiary’s Eligibility:The beneficiary must meet specific eligibility criteria, typically involving a disability and dependency on government benefits.

- Trustee Responsibilities:The trustee is responsible for managing the trust assets, ensuring compliance with the trust agreement, and making distributions to the beneficiary.

Seeking Legal Advice from Qualified Estate Planning Attorneys

Navigating the complex legal and tax implications of special needs trusts requires expert guidance. Consulting with a qualified estate planning attorney is crucial to ensure that the trust is properly established, compliant with state laws, and effectively protects the beneficiary’s interests.

- Expertise in Special Needs Trusts:Seek attorneys with specialized knowledge and experience in estate planning for individuals with disabilities.

- Understanding State Laws:An experienced attorney can ensure the trust complies with specific state laws and regulations.

- Tax Implications:An attorney can provide guidance on the tax implications of the trust and help minimize tax liabilities.

- Protection of Beneficiary’s Rights:An attorney can ensure that the trust safeguards the beneficiary’s interests and protects their eligibility for government benefits.

Resources and Support for Individuals with Special Needs

Navigating the world of special needs can feel overwhelming, but numerous resources and support systems are available to help individuals and their families. This section will provide information on organizations, government programs, and qualified professionals to assist in accessing the necessary resources.

Reputable Organizations and Resources

Many organizations dedicate their efforts to supporting individuals with special needs and their families. These organizations offer valuable resources, including information, advocacy, and direct services.

- The Arc: A national organization advocating for and supporting people with intellectual and developmental disabilities. The Arc provides resources, information, and advocacy on a wide range of topics, including education, employment, and housing.

- United Cerebral Palsy (UCP): UCP offers services and support for individuals with cerebral palsy and other disabilities. They provide resources on medical care, therapy, education, and employment.

- National Down Syndrome Society (NDSS): NDSS provides support and resources for individuals with Down syndrome and their families. They offer information on health, education, advocacy, and community resources.

- Autism Speaks: A leading autism advocacy organization, Autism Speaks provides resources, information, and support for individuals with autism and their families. They offer resources on diagnosis, treatment, education, and advocacy.

- Special Olympics: A global organization that provides year-round sports training and athletic competition for individuals with intellectual disabilities.

Government Programs and Benefits

Several government programs provide financial and other assistance to individuals with special needs and their families.

- Supplemental Security Income (SSI): A federal program that provides financial assistance to individuals with disabilities who meet certain income and asset requirements.

- Social Security Disability Insurance (SSDI): A federal program that provides benefits to individuals who are unable to work due to a disability.

- Medicaid: A state-funded program that provides health insurance coverage to low-income individuals and families, including those with disabilities.

- Medicare: A federal program that provides health insurance coverage to individuals aged 65 and older and those with certain disabilities.

- Special Education and Related Services: Under the Individuals with Disabilities Education Act (IDEA), children with disabilities are entitled to a free and appropriate public education.

Finding Qualified Professionals

Finding qualified professionals is crucial for individuals with special needs.

- Financial Advisors: A financial advisor can help individuals with special needs and their families plan for the future, including managing finances, investing, and protecting assets.

- Care Providers: Care providers, such as nurses, therapists, and social workers, can provide support and assistance with daily living activities, medical care, and therapy.

- Attorneys: An attorney specializing in special needs planning can help families understand legal options, create a comprehensive estate plan, and protect the rights of their loved ones.

Financial Planning for Individuals with Special Needs

Financial planning is crucial for individuals with special needs, ensuring their financial security and well-being throughout their lives. It involves carefully managing assets, income, and expenses to meet their unique needs and aspirations.

The Role of a Special Needs Trust

A special needs trust plays a vital role in managing assets and income for individuals with special needs. It allows individuals to receive supplemental support and resources without jeopardizing their eligibility for government benefits, such as Medicaid or Supplemental Security Income (SSI).

These trusts are specifically designed to preserve eligibility for these crucial programs, ensuring that individuals with special needs continue to receive the support they need.

Financial Strategies for Individuals with Special Needs

Financial strategies tailored to individuals with special needs aim to protect their assets and ensure their financial security. These strategies often involve:

- Establishing a Special Needs Trust:A special needs trust is a critical component of financial planning for individuals with special needs. It helps protect their assets while maintaining eligibility for government benefits. This trust allows for the distribution of funds for specific needs, such as education, housing, healthcare, and personal expenses, without jeopardizing their benefits.

- Asset Protection:Strategies for asset protection aim to safeguard the individual’s assets from potential risks, such as lawsuits or financial mismanagement. This may involve transferring assets to a trust, utilizing irrevocable trusts, or creating a limited liability company (LLC) to shield assets from personal liability.

- Income Management:Managing income is crucial to ensure financial stability. This involves budgeting, tracking expenses, and planning for future financial needs. For individuals with special needs, income management may also involve considering the impact of government benefits and ensuring compliance with eligibility requirements.

- Estate Planning:Estate planning ensures that assets are distributed according to the individual’s wishes after their passing. This may involve creating a will, establishing a trust, or designating beneficiaries for specific assets. Estate planning for individuals with special needs should consider the potential impact on their eligibility for government benefits.

- Long-Term Care Planning:Planning for long-term care needs is essential, especially for individuals with special needs who may require ongoing support. This involves considering various options, such as home care, assisted living, or nursing homes, and determining the best approach to ensure the individual’s well-being and financial security.

Examples of Financial Strategies

- Example 1:John, an individual with autism, receives SSI benefits. To ensure he has access to funds for his education and personal expenses, his family establishes a special needs trust. The trust allows John to receive supplemental support while maintaining his eligibility for SSI.

- Example 2:Sarah, an individual with Down syndrome, inherits a significant sum of money. To protect her inheritance and ensure her continued eligibility for Medicaid, her parents create a special needs trust. The trust allows for the distribution of funds for Sarah’s needs, such as housing, healthcare, and personal expenses, while preserving her eligibility for Medicaid.

Estate Planning for Other Financial Needs

Estate planning isn’t just about ensuring your loved ones are taken care of after you pass away. It also encompasses strategies for managing your finances and protecting your assets throughout your lifetime. This section will explore various estate planning tools that can help you achieve your financial goals, from safeguarding your assets to providing for your family’s future.

Comparison of Estate Planning Tools

Estate planning tools are designed to address different financial needs and objectives. Understanding the unique features and benefits of each tool is crucial for making informed decisions about your estate plan. Here’s a comparison of some common estate planning tools:| Tool | Description | Benefits | Considerations ||—|—|—|—|| Will| A legal document outlining how your assets will be distributed after your death.

| Simple and relatively inexpensive to create. | Doesn’t provide asset protection during your lifetime. May be subject to probate, which can be time-consuming and costly. || Trust| A legal entity that holds and manages assets for the benefit of designated beneficiaries.

| Offers asset protection and avoids probate. Can be used to manage assets for individuals with special needs. | More complex and expensive to create than a will. Requires ongoing administration and management. || Life Insurance| A financial product that provides a death benefit to your beneficiaries upon your death.

| Provides financial security for your loved ones. Can be used to cover debts, fund education, or replace lost income. | Premiums can be expensive. May not be suitable for everyone. || Power of Attorney| A legal document authorizing someone to make financial and legal decisions on your behalf if you become incapacitated.

| Ensures your financial affairs are managed according to your wishes if you’re unable to do so yourself. | Requires careful consideration of the person you appoint as your agent. || Living Will| A legal document outlining your end-of-life wishes, including medical treatment preferences.

| Ensures your wishes are followed in the event of a terminal illness or incapacitation. | Requires careful consideration and clear communication with your loved ones. |

Flowchart for Estate Planning for Different Financial Needs

The process of estate planning is often iterative and may involve adjustments based on changing circumstances. This flowchart illustrates a typical process for addressing different financial needs: Step 1: Define your goals.

- What are your financial objectives?

- Who are your beneficiaries?

- What assets do you want to protect?

Step 2: Gather information.

- Determine the value of your assets.

- Identify your beneficiaries and their financial needs.

- Consider your tax implications.

Step 3: Choose the right tools.

- Wills

- Trusts

- Life insurance

- Power of attorney

- Living will

Step 4: Create your estate plan.

- Consult with an estate planning attorney.

- Draft and execute your legal documents.

Step 5: Review and update your plan.

- Review your plan regularly to ensure it still meets your needs.

- Make adjustments as necessary.

Example:Imagine a family with a young child with special needs. The parents want to ensure their child’s financial security and provide for their needs throughout their lifetime. In this case, they might consider creating a special needs trust to manage the child’s assets and protect their eligibility for government benefits.

They might also establish a life insurance policy to provide a financial safety net for their child.

Related Financial Services

Estate planning for individuals with special needs involves various financial services that ensure their well-being and financial security. These services can help navigate complex financial situations, manage resources effectively, and protect their future.

Understanding the specific needs and goals of the individual with special needs is crucial for selecting the right financial services. A comprehensive approach involving a team of professionals, such as attorneys, financial advisors, and special needs planners, can provide tailored solutions to address diverse financial aspects.

Financial Planning

Financial planning plays a crucial role in ensuring the long-term financial stability of individuals with special needs. This involves developing a comprehensive financial strategy that considers their current needs, future goals, and potential financial challenges.

- Budgeting and Expense Management: Creating a detailed budget helps track income and expenses, ensuring financial resources are allocated effectively. It includes identifying essential needs, such as housing, healthcare, and education, and prioritizing spending based on available funds.

- Savings and Investment Planning: Establishing savings and investment plans can secure future financial stability. This involves identifying suitable investment options based on risk tolerance, time horizon, and financial goals.

- Retirement Planning: Retirement planning is crucial for individuals with special needs, ensuring financial security during their later years. This involves considering potential income sources, such as Social Security benefits, and developing a plan to meet their long-term financial needs.

- Insurance Planning: Adequate insurance coverage is essential for individuals with special needs, protecting them from unforeseen events. This includes health insurance, disability insurance, and long-term care insurance, depending on individual needs and circumstances.

Special Needs Trust Administration

Administering a special needs trust requires specialized expertise and knowledge. This involves managing the trust assets, ensuring compliance with legal requirements, and making distributions to the beneficiary as needed.

- Asset Management: Trust administrators are responsible for managing the trust assets, including investments, real estate, and other property. They ensure the assets are invested prudently and generate sufficient income to meet the beneficiary’s needs.

- Distribution Management: Administrators determine the appropriate distributions to the beneficiary, ensuring they meet their needs without jeopardizing their eligibility for government benefits.

- Compliance with Legal Requirements: Trust administrators must ensure compliance with all applicable laws and regulations, including tax laws and state regulations governing special needs trusts.

Legal Services

Legal services are essential for navigating the complex legal aspects of estate planning for individuals with special needs. This includes drafting and administering trusts, ensuring compliance with legal requirements, and protecting the beneficiary’s rights.

- Estate Planning Attorneys: Estate planning attorneys specialize in creating comprehensive estate plans, including wills, trusts, and powers of attorney. They can advise on the best trust structures for individuals with special needs, ensuring their financial security and legal protection.

- Special Needs Attorneys: Special needs attorneys have expertise in navigating the legal aspects of special needs planning, including Medicaid eligibility, disability benefits, and guardianship issues. They can provide guidance on creating and administering special needs trusts, protecting the beneficiary’s rights and maximizing their benefits.

Financial Services for Individuals with Special Needs

Financial services tailored for individuals with special needs offer specialized support and guidance in managing finances, protecting assets, and ensuring financial security. These services cater to unique challenges and requirements, providing personalized solutions.

- Special Needs Financial Planners: Special needs financial planners have specialized knowledge in managing finances for individuals with disabilities. They can provide comprehensive financial planning services, including budgeting, savings, investment, and insurance planning, tailored to the specific needs of the individual.

- Disability-Specific Financial Products: Financial institutions offer specialized products and services designed for individuals with disabilities, such as ABLE accounts, special needs trusts, and insurance plans tailored to their specific needs.

Other Financial Services

Other financial services can provide additional support and resources for individuals with special needs and their families, addressing various financial needs and challenges.

| Service | Description | Resources |

|---|---|---|

| Auto Loans | Specialized auto loans cater to individuals with disabilities, offering flexible financing options and tailored terms. |

|

| Bankruptcy Lawyers | Bankruptcy lawyers can provide legal guidance and representation in bankruptcy proceedings, helping individuals with disabilities navigate financial challenges and protect their assets. |

|

| Credit Counseling | Credit counseling agencies offer guidance on managing debt, improving credit scores, and developing healthy financial habits. |

|

Concluding Remarks

By understanding the nuances of special needs trusts and implementing a well-structured estate plan, families can provide their loved ones with a secure financial future, ensuring their well-being and independence for years to come. Remember, seeking professional guidance from qualified estate planning attorneys and financial advisors is essential to tailor a plan that meets individual circumstances and protects the rights and benefits of individuals with special needs.

Essential Questionnaire

What are the potential consequences of not having an estate plan for an individual with special needs?

Without a proper estate plan, individuals with special needs may face significant challenges, including:

– Loss of government benefits like Medicaid and Supplemental Security Income (SSI).

– Inability to access essential care and support services.

– Financial instability and depletion of assets.

– Disputes among family members regarding the management of assets and care.

How can I find a qualified estate planning attorney who specializes in special needs trusts?

You can find a qualified attorney by:

– Seeking referrals from other professionals like financial advisors or disability advocates.

– Contacting your local bar association or legal aid organization.

– Searching online directories that specialize in estate planning and special needs law.

Can a special needs trust be used to pay for education expenses for a child with a disability?

Yes, a special needs trust can be used to pay for education expenses, including tuition, fees, books, and other educational materials, without jeopardizing government benefits. It’s important to work with an attorney to ensure the trust is structured correctly to maximize benefits and avoid unintended consequences.